If Rough was a car, you'd scrap it and buy a new one. But it's actually the UK's biggest gas storage facility, and supplies up to 10% of peak winter demand for gas. A few weeks ago I wrote about how planned maintenance was preventing Rough being filled with gas until early August. Well, the news has now got worse. The BBC summarises it here, but here's the detail straight from Centrica's website:

On 22 June 2016, CSL announced that in the course of conducting the testing works it had identified an additional issue with one of the wells. This resulted in CSL ceasing all injection and withdrawal operations pending the further testing in relation to the issue identified. This program of testing was estimated to last at least 42 days.

CSL has now ended the 42-day testing program early and has plugged the affected well. However, the affected well has identified potential uncertainties in the remaining untested wells. CSL will therefore continue with an enhanced version of its original calliper run and seal testing program. We estimate completion in March to April 2017. In the meantime because of the uncertainty as a prudent and safe operator CSL cannot inject or withdraw gas from Rough.

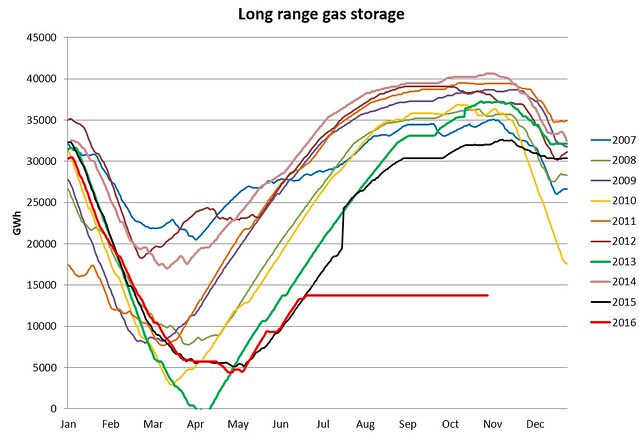

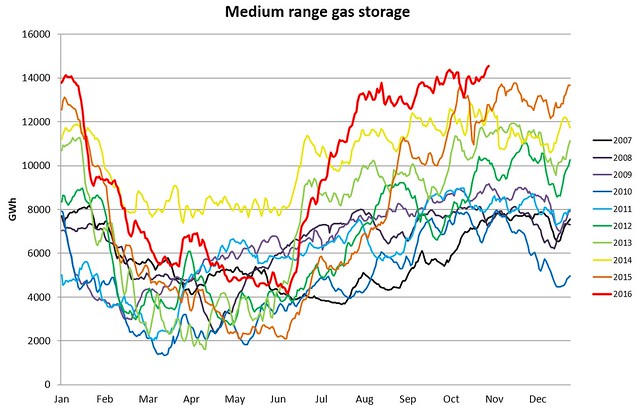

CSL is also examining the feasibility of returning a number of wells to service for the Winter 2016/2017 withdrawal season. CSL anticipates it will complete this study by 30 October 2016. CSL currently anticipates that at least 4 wells will return to service for withdrawal operations by 1 November 2016. In respect of injection CSL cannot increase the Rough reservoir pressure during the testing programme.

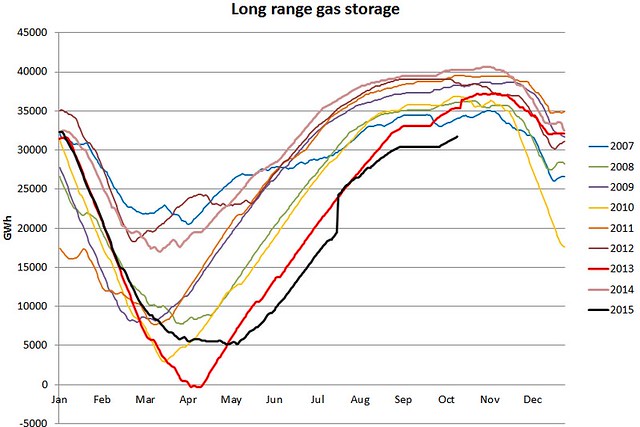

If you're wondering how big an impact plugging one well is, and what possibly having four wells open in November means, the

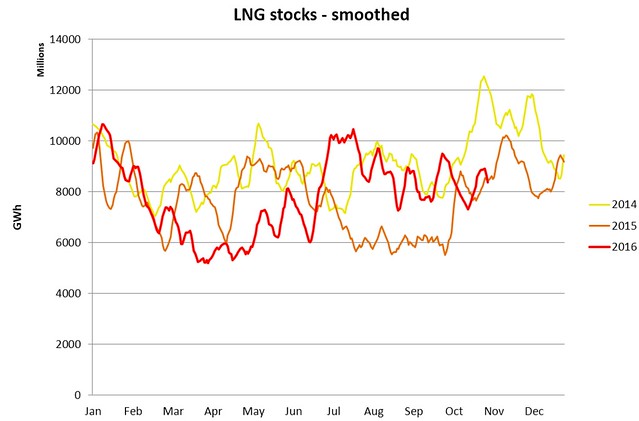

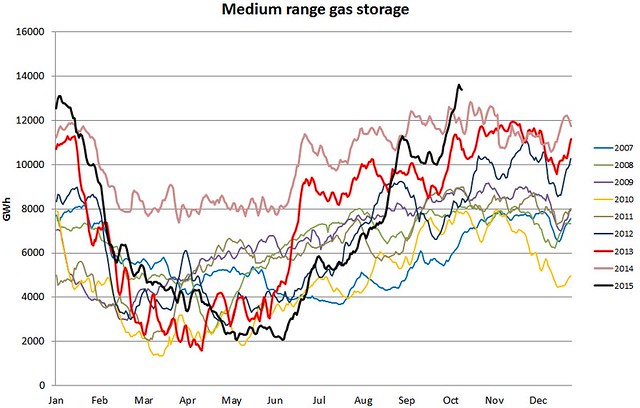

Operational Guide to Rough from 2015 says that it had 24 operating wells for injection, and 29 for withdrawal. Rough is currently about a third full, so opening some wells for withdrawal in November is of some use, but with no chance to inject any new gas, the UK is going to be left exposed to any further malfunctions or international incidents, and may even struggle to cope with a moderately cold winter. The ability to import LNG will be crucial to maintaining supply over this winter - this may work fine, but will cost us more, as we will have to outbid other countries to make sure we get what we need.

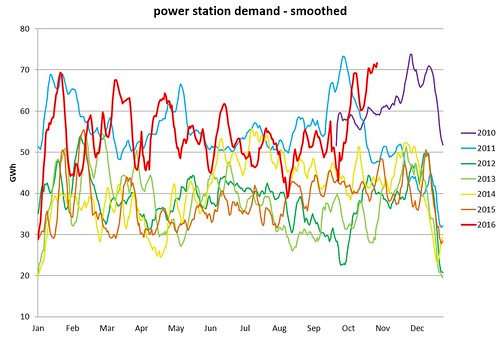

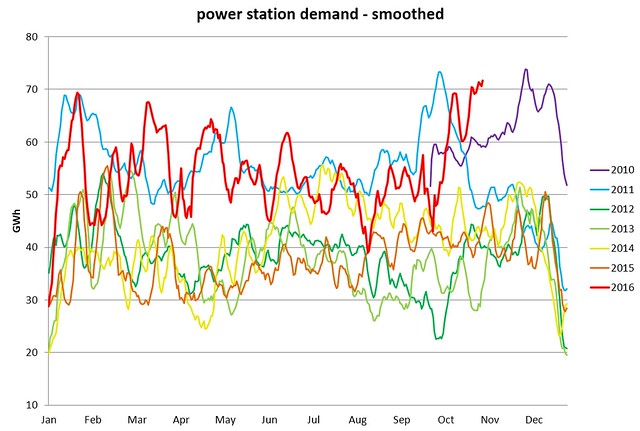

It's worth remembering that in Q1 2016 38% of the UK's electricity was generated by burning gas - this represents 25% of total gas use in the UK (data from

here). So a shortage of gas implies a potential shortage of electricity, especially with more of our ageing coal plants having shut down over the past year.

One slightly odd thing is that National Grid's

Prevailing View website is missing information on gas storage. One could be forgiven for thinking they're trying to avoid scaring people...

We may get more news, good or bad, on Rough over the coming months, but the key thing to look out for now will be long range winter weather forecasts. Time to start praying for a mild winter I think...

Click here to read the rest of this post.