The latest Energy Trends have been published by DECC, so here's a summary... (all graphs are copied from the publication)

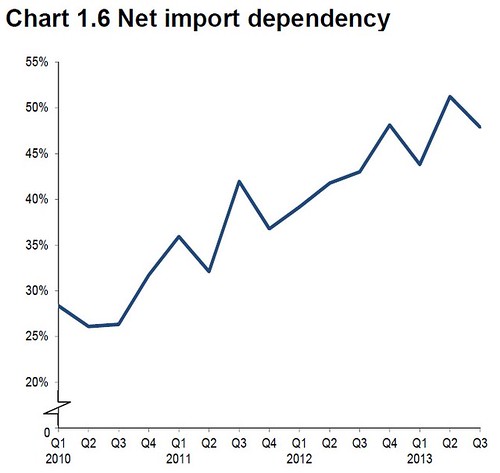

Unsurprisingly, the upward trend in net UK energy imports continues:

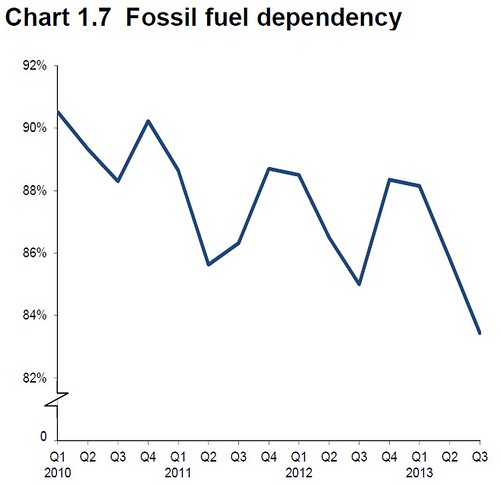

At least fossil dependency is coming down, though this includes nuclear:

Coal

Coal mines have been closing - production is down 32% over last year. Imports are up 12%, and mainly come from Russia, Columbia and the USA. Total consumption is actually down 2.8% on a year ago, due to a reduction in the use of coal for generating electricity - coal use in other areas increased significantly.Oil and petroleum products

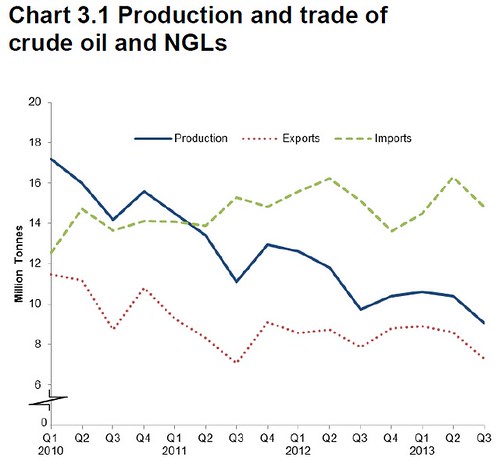

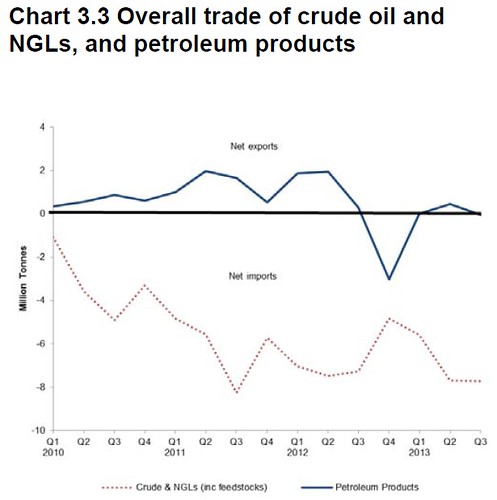

The downward trend of oil and NGL production has continued, with a new post-peak low being hit in Q3 - down 7% on a year ago:The following graph shows net trade in both crude oil and petroleum products. Unsurprisingly, the UK is importing a lot of crude oil, but our traditional position as an exporter of petroleum products is also being eroded as refineries are closed down:

Gas

Gas production actually declined less than in recent times, with a drop of 3.8% compared to a year ago. However, this is due to the return to production of the Elgin field, which shut down due to a leak in March 2012, rather than any pause in the overall decline. Demand for gas was down 8.2% on a year ago, due to warmer temperatures and less gas being burned to generate electricity.Electricity

Electricity demand was down 0.6% compared to a year ago, although this combines a rise in industrial use and a fall in domestic use. Interestingly, domestic use was the lowest for Q3 for fourteen years! Electricity generated from renewable sources increased from 11.7% in Q3 a year ago to to 13.2% this year, although this is lower than the 15.4% reached in Q2 2013. Lower wind speeds resulted in reduced generation despite increased capacity, but this was compensated for by conversion of coal fire power stations to burn biomass instead. This is controversial though, as the biomass used is imported rather than being sourced from within the UK.Generation from solar PV was up 31.9%, due to increased capacity, but hydro was down 26.6% due to low rainfall. In terms of installed capacity:

- onshore wind was up 25% at 7,120MW

- offshore wind was up 36.3% at 3,657MW

- solar PV was up 57% at 2,542MW

- anaerobic digestion was up 33.5% at 122MW

So, nothing shocking this quarter - a continued decline in fossil fuel production, a steady but slow rise in renewable energy, and a few new highs and lows set compared to recent years.

Mike Click here to read the rest of this post.