A couple of days ago the latest UK government Energy Trends publication was released by DECC. As is now normal, it does not make cheery reading...

Production

Here's the headline figures for 2012 UK energy, compared to 2011:- Total energy production down 10.5%

- Oil production down 14.5%

- Gas production down 14%

- Coal production down 10%

- Hydro, wind and solar generation up 21%

There are also figures focused on the fourth quarter of 2012, comparing it to Q4 2011. The results there are even worse than for the year as a whole:

- Total energy production down 14%

- Oil production down 20%

- Gas production down 21%

- Coal production down 10%

- Hydro, wind and solar generation up 7.5%

Imports

Here's the figures for how much we were importing, given for 2012 as a whole and then for Q4 2012:- 43% of all energy was imported through 2012, rising to 48.7% in Q4

- About 39% of oil demand was met by imports, falling to 36% in Q4 as refinery demand reduced after the closure of Coryton refinery

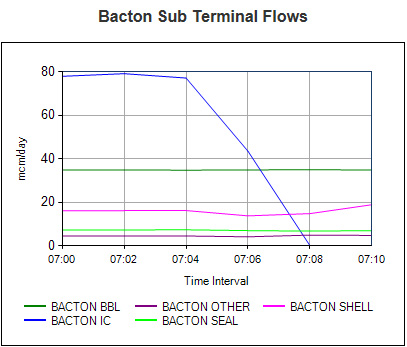

- About 47% of gas demand was met by imports, rising to 55% in Q4

- About 70% of coal demand was met by imports, falling to 64% in Q4

We're also a net importer of petroleum products, such as petrol, diesel and jet fuel, after the Coryton refinery shut last year - so the reduction in oil import dependency was offset by an increase in dependency on imports of the finished products.

Electricity

Looking at electricity in more detail, a few key points are worth noting:- Coal's share of electricity generation increased from 29.5% in 2011 to 39.3% in 2012, while gas went in the opposite direction, from 39.9% to 27.5%. This was due to price variations and upcoming carbon taxes for burning coal, combined with the remaining hours left to run on coal plants opting out of compliance with the LCPD. As many of these plants are closing during 2012 (some have already closed), the balance may be expected to swing from coal back to gas again in 2013.

- Net imports of electricity doubled from 2011 to 2012, and represented 3.4% of total supply.

- Installation of renewable energy capacity is still going ahead quickly, and new record generation was recorded, but it is still a relatively small proportion of overall energy.

Summary

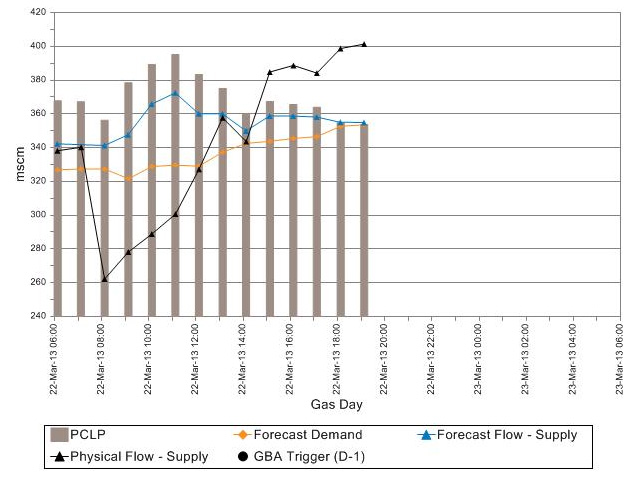

Well, what can I say? We're producing less, importing more, but only using a little bit less energy. With the various ongoing gas supply problems I've been reporting on this blog, it is imperative that the whole of the UK takes action to reduce energy use, particularly for heating and electricity, before we get to winter 2013/14. The alternative is that we pay more. A lot more.Click here to read the rest of this post.