Back in April I wrote about the effect of the nuclear disaster in Japan on gas prices globally and in the UK. Well, the situation continues to develop... Not only are the reactors at Fukushima still not in cold shutdown, but other reactors are being shut down for problems which previously might have been ignored, due to the public reaction to the situation. On top of this, there is a strong possibility that Japan may try to become nuclear-free.

A recent Reuters article gives some more info, suggesting that if all nuclear plants are shut down in Japan their crude oil imports may almost triple as crude oil and fuel oil are burned to generate electricity. Of course, this would mean high CO2 emissions, so in practice they will be burning a lot more gas so that oil doesn't increase by so much. LNG imports are already up 30% on a year ago, and the article predicts that ultimately we could see global prices go up by almost 50% from where they are now.

What this really comes down to is that globally we are now close to a zero-sum game for energy. If one source (Japanese nuclear plants) disappears, and is replaced by oil and gas from the global market, then someone else has to do without that energy. We don't have physical rationing, so instead we will get rationing by price - the cost of fuel will rise until some consumers can no longer afford it, whether that's entire countries or individual households.

Mike

This blog aims to provide the latest news and comment relating to Peak Oil, and related issues such as supply of other fossil fuels, renewable energy, sustainability and finance. Global issues are covered from a UK perspective.

Saturday 16 July 2011

Continuing Fukushima impact on oil and gas prices

Friday 1 July 2011

Huge decline in UK oil and gas production in Q1 2011

The latest instalment of DECC's Energy Trends series has just been published, covering Q1 2011. You can download a copy here (1.8MB PDF).

The summary page says it all really, with these bullet points:

- Total energy production was 11 per cent lower than in the first quarter of 2010.

- Oil production was 15½ per cent lower than in the first quarter of 2010, due to maintenance activity and slowdowns.

- Natural gas production was 17½ per cent lower compared with the first quarter of 2010. Net imports of gas increased by ½ per cent. Liquefied Natural Gas (LNG) accounted for 43½ per cent of gas imports.

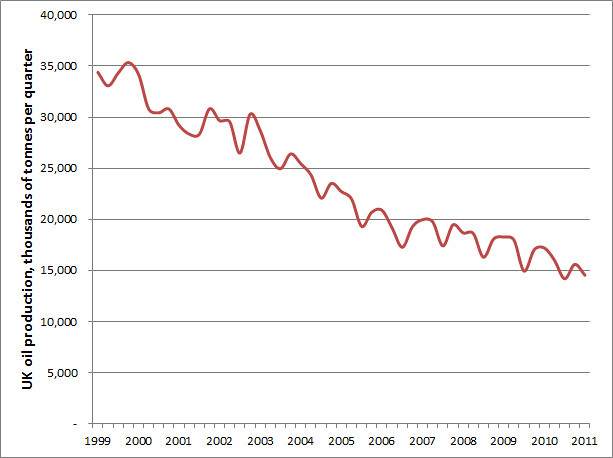

Here's a chart of quarterly oil production in the UK, from the start of 1999 to Q1 2011:

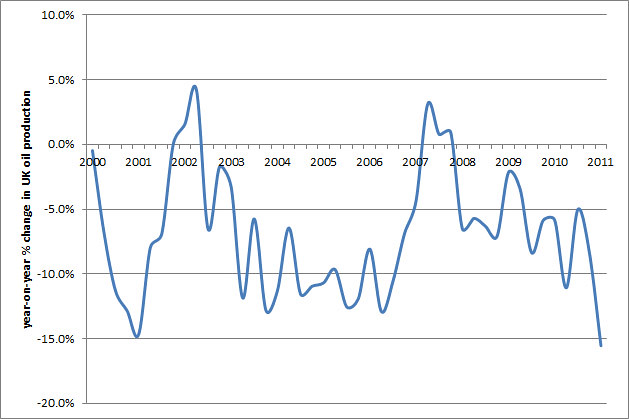

Not looking too promising, is it? To help see the trend, here's a graph showing the % change year-on-year from 2000 to 2011:

As you can see, there's been the odd blip where production has risen, but the last time was in 2007, and the first quarter for this year set a new record for the decline.

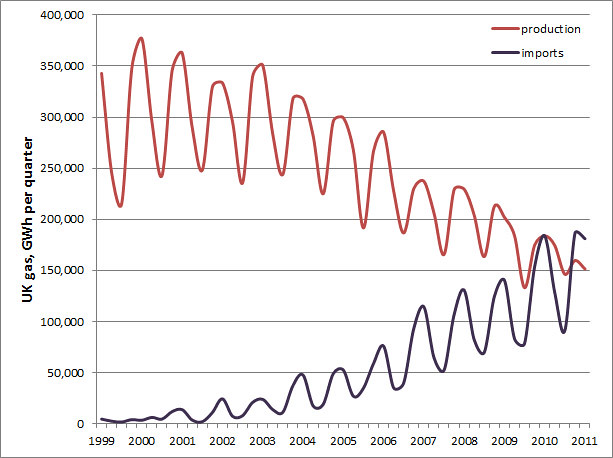

Moving on to gas, here's the another production graph, but this time I've added on the amount being imported as well:

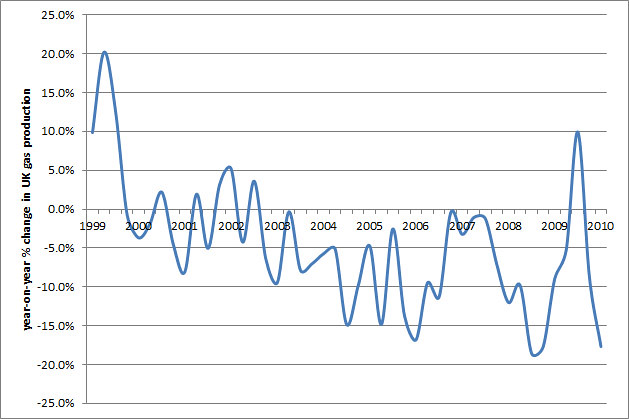

As you can see, there's a similar trend as for oil, though with greater seasonal fluctuations. I think this is probably because the gas market is more fluid, with pipelines connecting us to Europe, meaning production is often slowed down while prices are low. Here's a percentage change graph again, with the same high fluctuations, and close to a new record on decline:

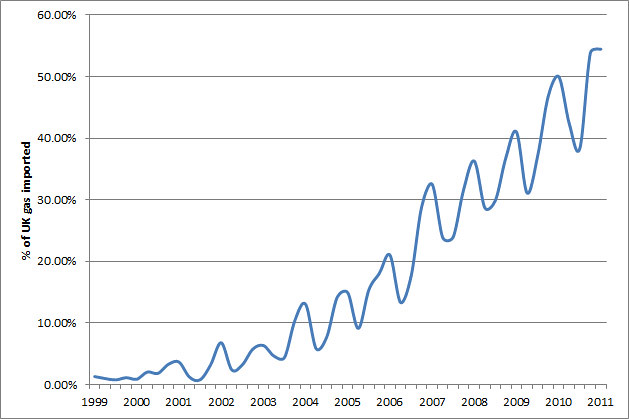

Just to reiterate the problem we have with gas, here's another graph showing the percentage of UK gas supplied by imports, on a quarterly basis:

As you can see, we imported more than half our gas in the final quarter of 2010, which isn't surprising as it was very cold, but also in the first quarter of 2011 - when it was actually relatively mild!

Many thanks to DECC for providing these figures publicly - shame the government isn't taking the urgent action which the graphs above should prompt them to. It's not just about energy security and keeping the lights on this winter, it's also about whether we can afford the imports. To put it in context, wholesale gas has been trading on the National Grid at about 2p/kWh this summer. The graphs above are in GWh, one of which would cost £20,000 at the same rates.

In the past two quarters we've imported over 367,000 GWh - that's about £7.3 billion worth of gas. So if anyone was still wondering why gas prices are going up, now you have part of the answer...

It's summer now, but winter is coming - take the time over the coming months to insulate your walls and loft if you've not already done so, and if you want to do even more, take a look at my other blog for some ideas. Click here to read the rest of this post.

Labels:

decc,

energy trends,

gas,

oil,

peak oil,

production,

uk

Subscribe to:

Posts (Atom)