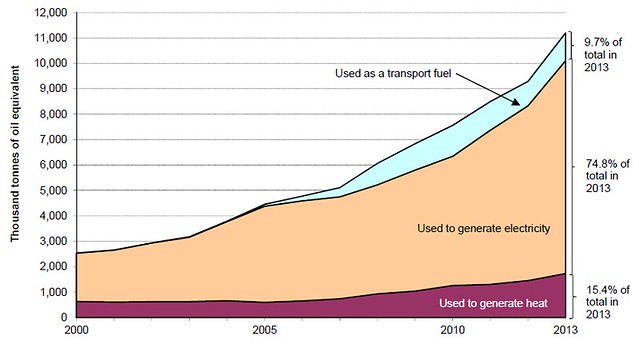

Just to make a change, the latest Energy Trends publication from DECC is not all bad news! The statistical press release actually starts with this graph, showing how renewable energy supply has grown rapidly in the UK recently:

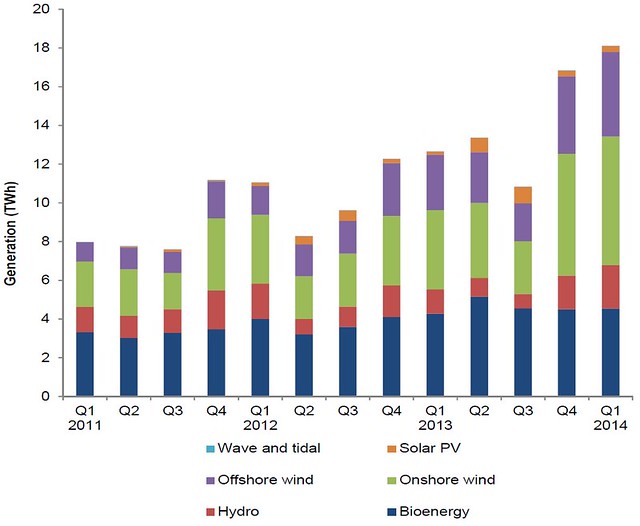

The biggest chunk of this is electricity, so here's how the overall electricity supply looked in the first quarter of 2014, compared to a year ago:

What's interesting to note here is that while renewable energy supply did increase significantly in absolute terms, from 12.7 TWh a year ago to 18.1 TWh this year (43% increase), the reason its share in the chart above increased so dramatically is because the mild winter reduced demand for electricity by 10.4% compared to a year ago. What's really significant here to me is that the cut in demand was reflected in a big reduction in coal and gas burned to generate electricity - which is of course what is supposed to happen as renewable energy generation increases. But it underlines the fact that cutting demand has a huge impact on the proportion of energy we supply from renewable sources.

Although renewable energy capacity had increased over the past year, the other thing that boosted generation was the exceptionally wet and windy weather the UK experienced this winter. Probably not enough of a 'silver lining' to make it worth it for the people who got flooded though... The effect of the weather is shown clearly in the breakdown of renewable energy generation below, with wind and hydro well up on a year ago.

The seasonal trend of more solar power in the summer and more wind/hydro in the winter is clearly shown above as well, which makes a good case for increasing the amount of installed solar PV to even out renewable supply across the year. Though having said that, demand is higher in the winter anyway, so maybe it's not too big a deal.

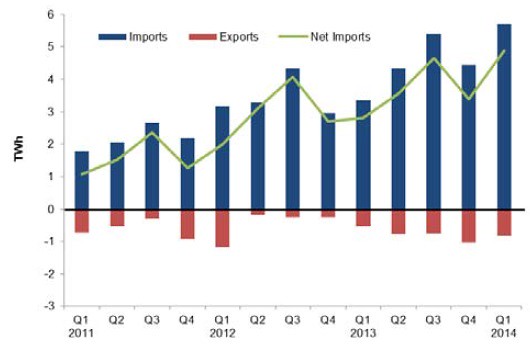

I'm afraid there's one not so good chart included for electricity though, and that's the one showing our net imports, which are steadily rising:

Clearly this isn't a good thing for energy security, or for the UK balance of payments. Perhaps it's a sign of our steadily ageing generation infrastructure?

Moving on to fossil fuels, there's not a huge amount to report really:

- Coal production was down 27.7% on a year ago.

- Gas production was down 0.2%, but imports were down significantly due to the mild winter

- Oil production was actually up 3.5% for a change!

So, nice to have some good news to report on the renewables front, even if the overall picture hasn't changed a great deal.

Click here to read the rest of this post.