Just a very quick note here to update the earlier post I did about UK gas supply in the 2011/12 winter. A story on Bloomberg about daily price movements in the UK gas markets noted that:

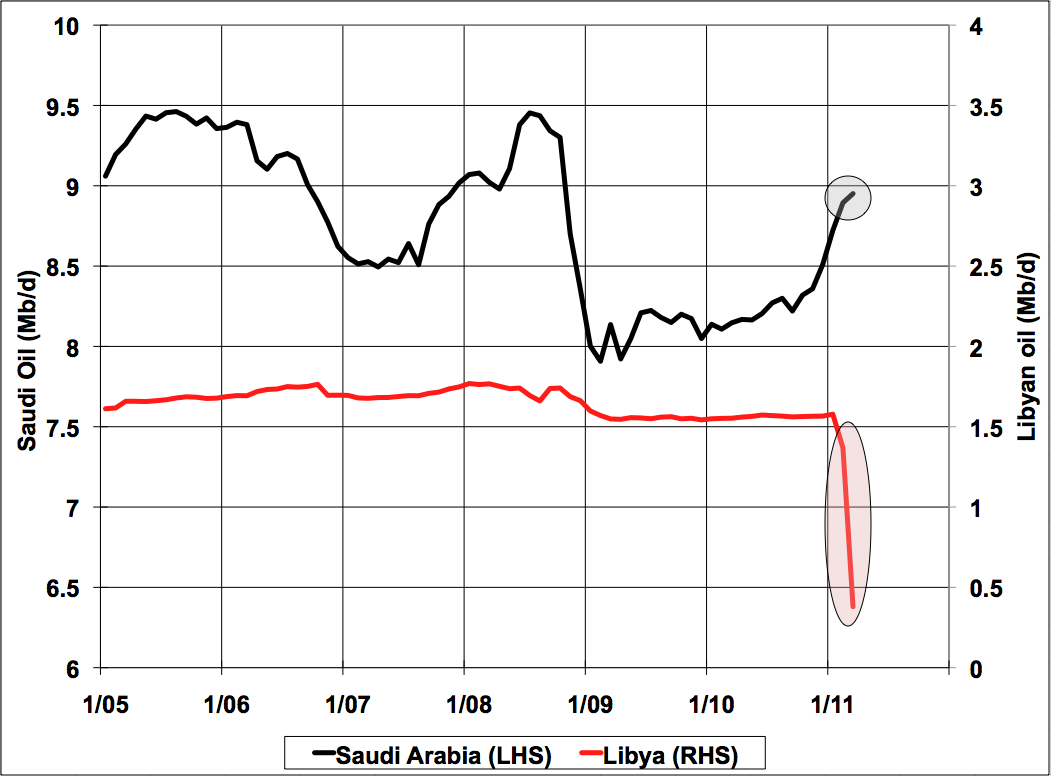

Goldman Sachs Group Inc. said in a report yesterday that the continuing 30 million cubic meters a day of missing supply from Libya and an increase of 18 million cubic meters a day in liquefied natural gas demand from Japan following the earthquake on March 11 "have the potential to eliminate the supply overhang in the global LNG market, bringing it to balance." full storyThis puts some numbers on the issues I brought up in the earlier post, and makes it clear that UK gas prices are going to be staying high for some time...

Mike Click here to read the rest of this post.