The UK Met Office has released it's long range outlook for Nov 2016 to Jan 2017, and it's expecting at least the first part of the winter to be a bit colder than average - there's some in depth discussion of it in this BBC video. So now's a good time to review what shape UK gas supplies are in.

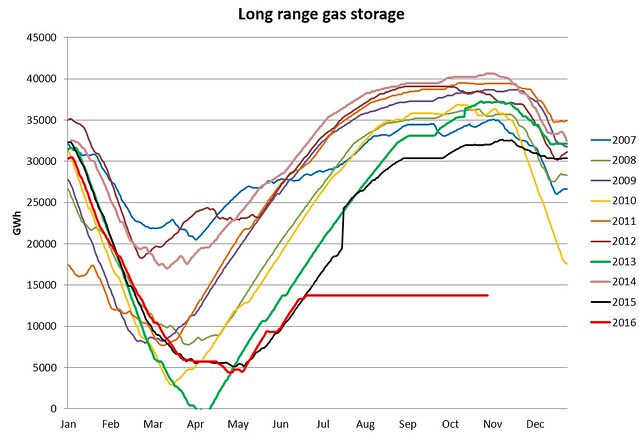

A few months ago I commented on the news that the long range storage at Rough was out of action and only about one third full. At the time Centrica was expecting withdrawal from Rough to be possible by 1 Nov, but the latest statement on their website now says second half of November. The graph below (click it for a larger version) shows the storage level in Rough over the past decade, with 2016 in red. As you can see, no gas has been injected for some months, leaving the store short of about 26,000 GWh of gas, which is unprecedented in the past decade.

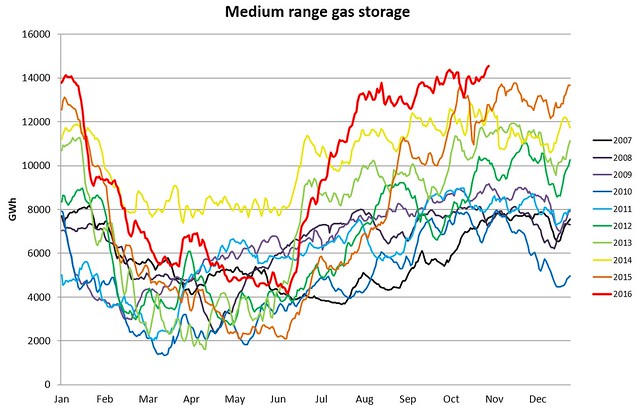

To be fair, the operators of the medium range storage sites have done their best, with gas stored at record levels - but this only equates to an extra couple of thousand GWh compared to recent years, so does not offset the missing gas from Rough.

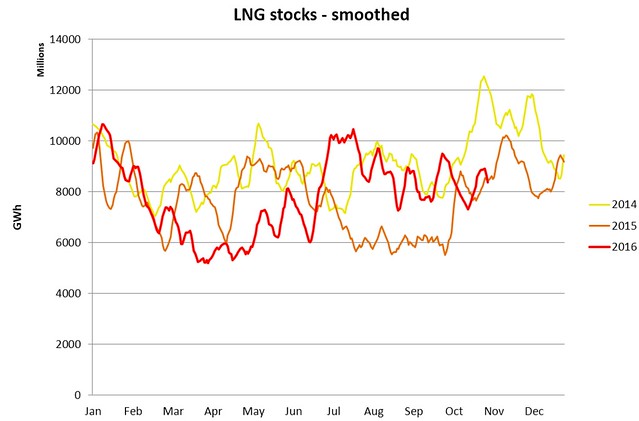

LNG stocks are at a fairly typical level, but these fluctuate as imports arrive periodically - the hope will be that more LNG tankers will arrive this winter than a year ago.

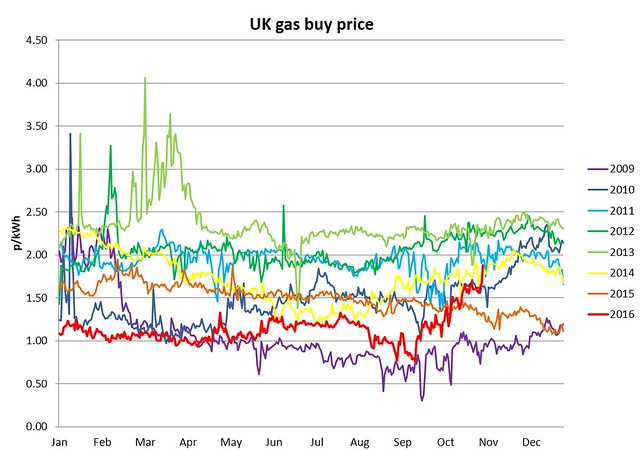

The impact of Rough's outage and low stock is showing up in wholesale gas prices, which have more than doubled over the past two months - this has yet to feed through into consumer bills.

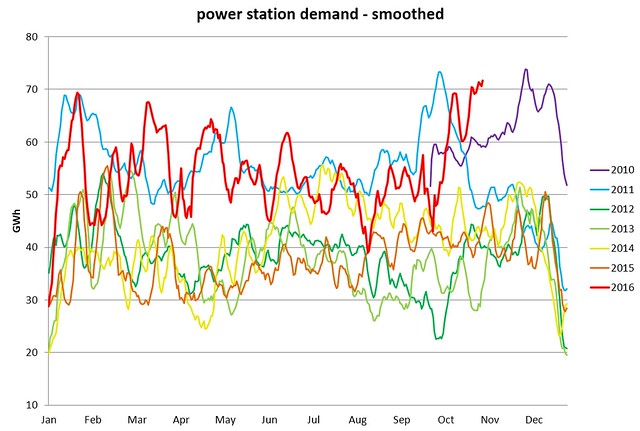

The other important factor to bear in mind is what's happening with electricity generation. A significant number of coal-fired power plants have closed in the past year or two, and this is good as they are high emitters of CO2. But the slack has been taken up by gas-fired power plants instead, rather than solely renewable energy or nuclear power. The graph below shows how power station demand for gas is at a multi-year high for this time of year.

So what's the conclusion? Well, if it doesn't get too cold, Rough comes back online as planned, nothing else breaks and we get enough LNG deliveries, then we'll just see prices rise. If one or more of those factors doesn't work out favourably, then it may become necessary to restrict industrial gas or electricity usage, to ensure that gas supply to homes can be maintained. Let's hope and pray that we don't get another winter like 2010/11:

Mike

This blog aims to provide the latest news and comment relating to Peak Oil, and related issues such as supply of other fossil fuels, renewable energy, sustainability and finance. Global issues are covered from a UK perspective.

Thursday, 3 November 2016

Outlook for UK gas supply in winter 2016/17

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment