So, oil prices are falling again - down to close to $60, compared to over $100 just a few months ago. Good news for economies and motorists around the world? Or a sign of problems to come?

Prices last fell dramatically in 2008, dropping from $145 in July to $30 in December of that year. Of course, this was due to falling demand caused by a global financial crisis - brought on in part by the rising price of oil forcing homeowners to default on their sub-prime mortgages in order to keep buying ever more expensive food and gasoline. Since then, the oil price crept steadily back up again as economies recovered and expensive oil production was mothballed, clearing $100 in 2011 and staying around that level until the recent fall.

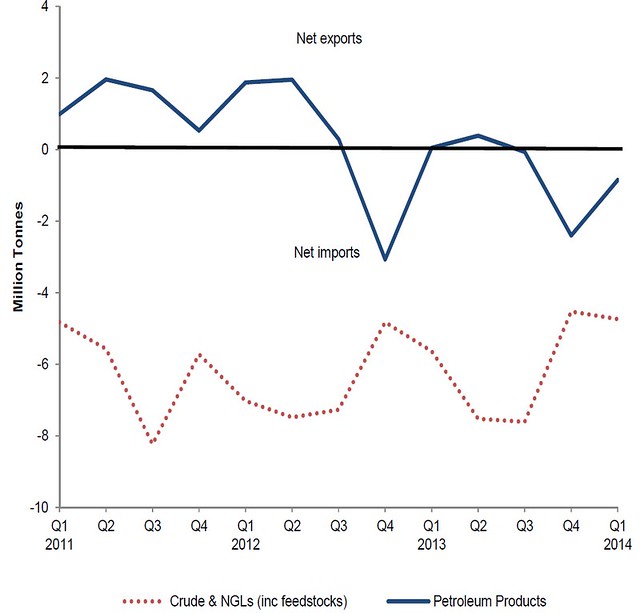

So what's happening this time? Well, two key factors are the risk of weakening demand in some parts of the world due to economic issues, and the increase in USA oil production through the fracking of shale oil. Possible falling demand combined with rising supply has reduced the price. Normally, OPEC would act at this point, reducing oil production to support prices. But this time Saudi Arabia has political motivations, as noted by the BBC recently, wanting to punish countries like Russia and Iran, who are being badly hurt by the falling oil price right now. Saudi Arabia is hurt too, but it has a much bigger financial cushion, so can survive for some time yet on lower prices.

So what will the impact be, beyond lower transport costs in the short term? Most of the new oil supply that has come from US fracking needs a high oil price to be profitable - higher than the price is right now (estimates vary from $65 to $80), so fracking companies will be wondering whether they should pause or halt production, and save the oil for a time when prices are higher and they can make a profit selling it. But the problem is they've borrowed money to get started, and that money has to be paid back no matter what the oil price is. Some people even think this might trigger a new financial crisis, as there is over $200 billion in 'junk bonds' in the energy sector. This isn't a USA-specific issue, Barclays is involved in an $850 million loan which may not be paid back in full.

Looking further ahead, when demand for oil picks up again, the shutdown of expensive oil production like fracking, and also tar sands, would mean that prices could jump up significantly, as it would take time to bring this production back online.

Finally, there's another factor affecting future oil production - the risk of falling investment. Anybody who's grasped the climate change issue understands that if we want to keep global temperatures from rising too high we can't burn all the fossil fuel resources we know about, never mind resources we haven't found yet. But companies, and even whole countries, are valued by stock and bond markets according to the quantity of fossil fuel reserves they own or have a right to produce. If some of these reserves have to be left in the ground, then the shares of these companies and the national debt of certain countries could be over-valued right now - a 'carbon bubble'. In fact, The Bank of England is researching the risk of this right now, as reported by The Guardian:

The Bank of England is to conduct an enquiry into the risk of fossil fuel companies causing a major economic crash if future climate change rules render their coal, oil and gas assets worthless.

The concept of a “carbon bubble” has gained rapid recognition since 2013, and is being taken increasingly seriously by some major financial companies including Citi bank, HSBC and Moody’s, but the Bank’s enquiry is the most significant endorsement yet from a regulator.

The concern is that if the world’s government’s meet their agreed target of limiting global warming to 2C by cutting carbon emissions, then about two-thirds of proven coal, oil and gas reserves cannot be burned. With fossil fuel companies being among the largest in the world, sharp losses in their value could prompt a new economic crisis.

The UK Energy Secretary, Ed Davey, has also been talking about this issue with regard to pension funds, as reported by The Telegraph:

"One has got to worry about the investments for pensioners.In summary, there are more than simple market forces at play in the oil price right now, and the consequences of any action, or inaction for that matter, will be far-reaching. Governments would do well to give some serious thought to two key problems - how to get off our addiction to oil (and fossil fuels in general), and how how do it without causing another financial crisis as the big fossil fuel companies are wound down. Click here to read the rest of this post.

If pension funds are investing in companies or banks that have on their balance sheets huge amounts of assets in fossil fuels, and those assets don’t give the return that people expect – because of changes in technology where low-carbon becomes cheaper or because of the world having to take action against carbon emissions – one has got to protect those pensioners and those investments."